Speer: Turns Out Alternative (Meat) Isn’t Really An Alternative

Alternative: existing or functioning outside the established cultural, social, or economic system. And generally, the associated connotation being that it’s somehow edgier, sexier, better, smarter (while the established system is often archaic, slow, stodgy, and ignorant). At least, that’s how it goes in the protein world.

About a year ago, based on repeated questions from producers, I wrote a column on the current status of alternative meats. I noted the space is, “…being challenged by declining pricing power.” Last year, the sector was forced to increasingly rely on promotion to keep product moving.

Fast forward to the first half of 2022 and address market position amidst surging inflation. Maybe rising prices provides alternative meats some traction with consumers? That’s best answered by analysis from the 210Analytics monthly retail report (Anne-Marie Roerink, Principal).

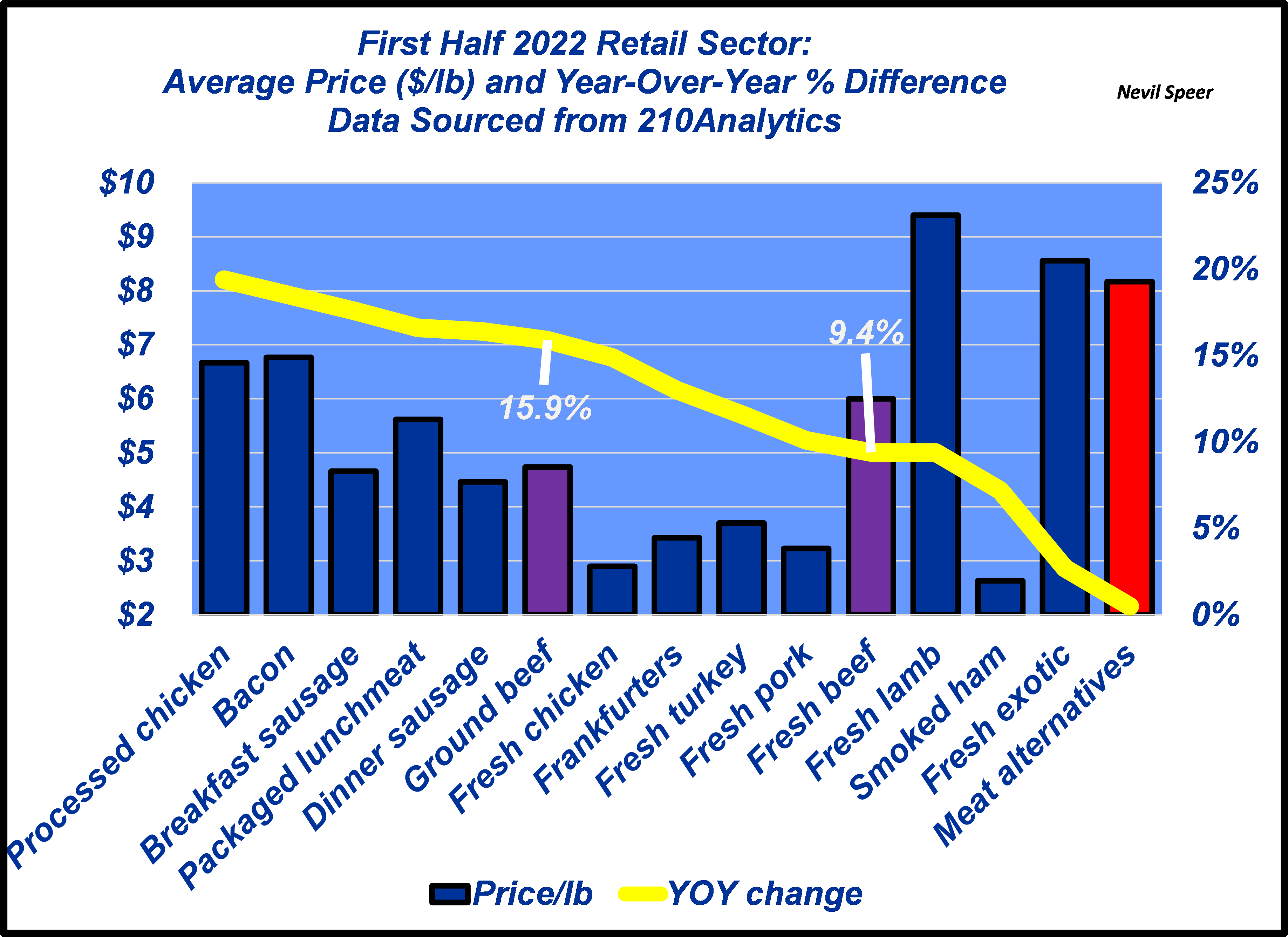

Through June, most meat products have seen sharp price increases year-over-year (see chart). Ground beef is up nearly 16% versus year-ago prices and fresh beef up roughly 9.5% compared to last year. However, the alternative meat sector is at the bottom of the pack when it comes to pricing power; the sector has been unable to raise prices and pass on higher costs to consumers.

This has even more meaning given some of the further commentary by 210Analytics about consumer behavior within the inflationary environment: “…81% of grocery shoppers made changes to what and where they purchased in June. This is up from 50% in the fall of 2021. The dominant changes are looking for sales specials (54%), skipping non-essentials (45%), finding coupons (33%) and buying more private or other low-cost brands (29%).” In other words, shoppers are looking for bargains.

However, despite that reality, promotions aren’t working for alternative protein. The report noted, “Meat alternatives remained 15% below year ago, in dollars, volume and units, despite mild deflation and heavy promotions. Retailers are actually pulling back on items in the case to rightsize the category.” Yes, you read that correctly! Retailers are shrinking the space – shoppers simply aren’t interested (no matter the price reduction).

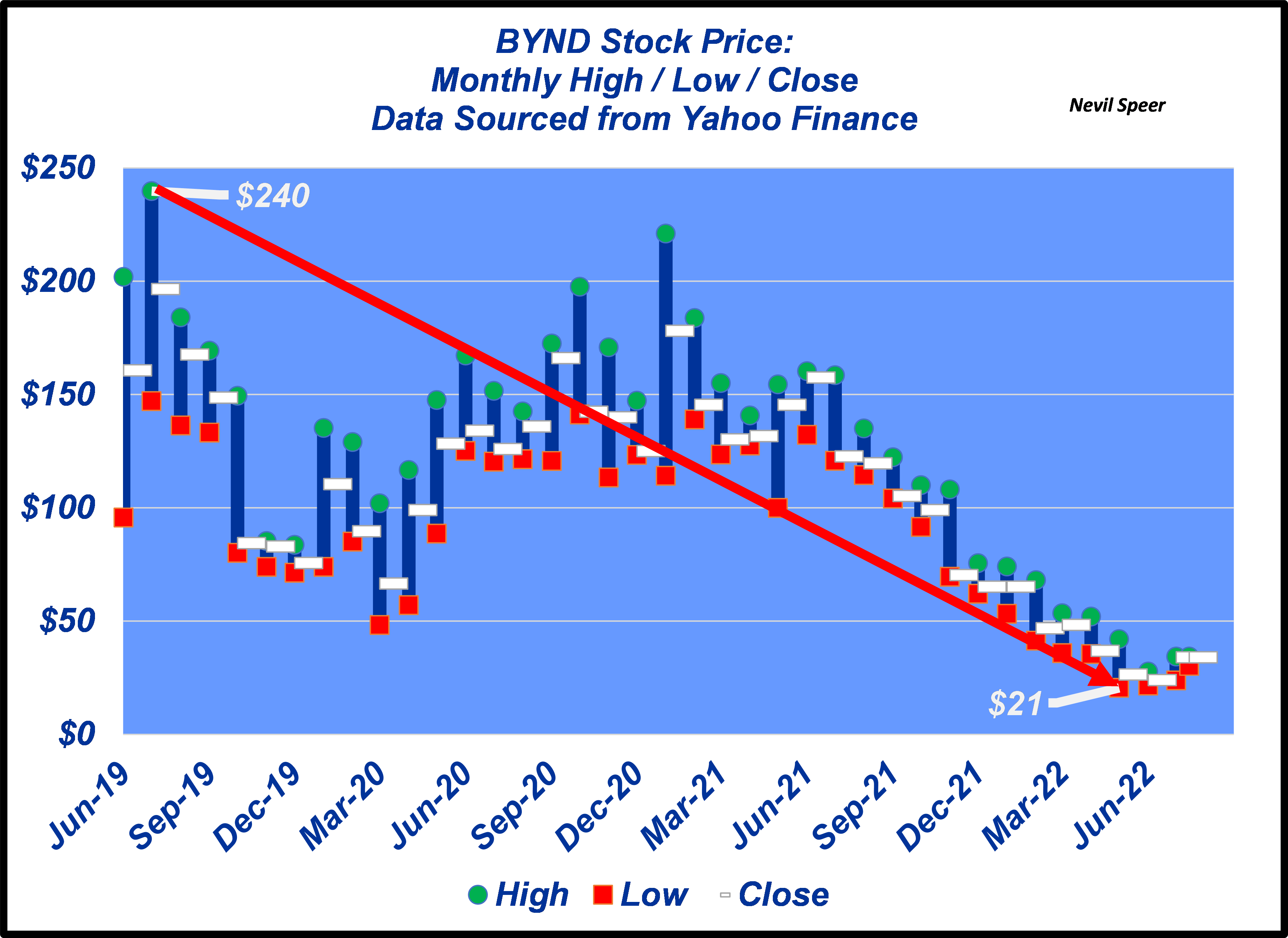

The best window into the health of the sector is through publicly traded Beyond Meat (ticker: BYND). The Wall Street Journal recently reported that Beyond’s CEO, Ethan Brown, is looking long-term: “I don’t think in quarterly terms, I don’t think in annual terms, I think in a longer-term perspective and we will deliver on this, I am absolutely certain.” That all sounds good. But the company’s trailing twelve month returns represent a loss of $255 M. Moreover, the quarterly losses are accelerating: $20M, $55M, $80M and $101M for quarters ending 30-Jun, 30-Sep, 31-Dec and 31-Mar, respectively.

Most significant, investors are also running out of steam. The stock peaked in July, ’19 at roughly $240/share; since that time valuation has steadily eroded and bottomed recently at $20/share in May. Based on 63.5M shares outstanding, that’s a market cap swing from $15.2B all the way down to $1.3B – an erosion of nearly 90%!

Let’s circle back what alternative means. It’s also defined as one of two or more available possibilities. On one hand there’s option A; and on the other hand, there’s option B. But when it comes to protein, turns out consumers are telling us that alternative (functioning outside the established norm) isn’t really an alternative (option) after all.

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at Nevil.Speer@turkeytrack.biz