Packing Plant Fool's Gold

Cowboys have worked themselves into a frenzy over U.S. packer capacity since the Tyson fire temporarily shuttered a giant plant three years ago. Monday morning packers are convinced the solution to low cattle prices is more carcass hooks. Support for that theory grew exponentially with the COVID black swan.

All packers – not just the Big 4 – fell into crisis in spring 2020 as workforces shrunk and safety protocols forced spacing between employees. Predictably, cattle slaughter slowed (Sterling Marketing estimates beef packer capacity utilization fell to 64% by mid-April 2020), feedlots were forced to hold ready cattle and cash prices for fed and feeder cattle dopped sharply. Oh, and packer profit margins skyrocketed.

Those are facts. Interpretation of those facts, however, is often disputed and has led some stakeholders to consider a perilous business endeavor. I’m referring to the caravan of folks lining up to build new beef packing plants. Exaggerated packer profit margins lures ranchers, feedlot managers and others into a venture most know little about.

It’s packing plant fool’s gold. That’s an opinion, but one based on facts.

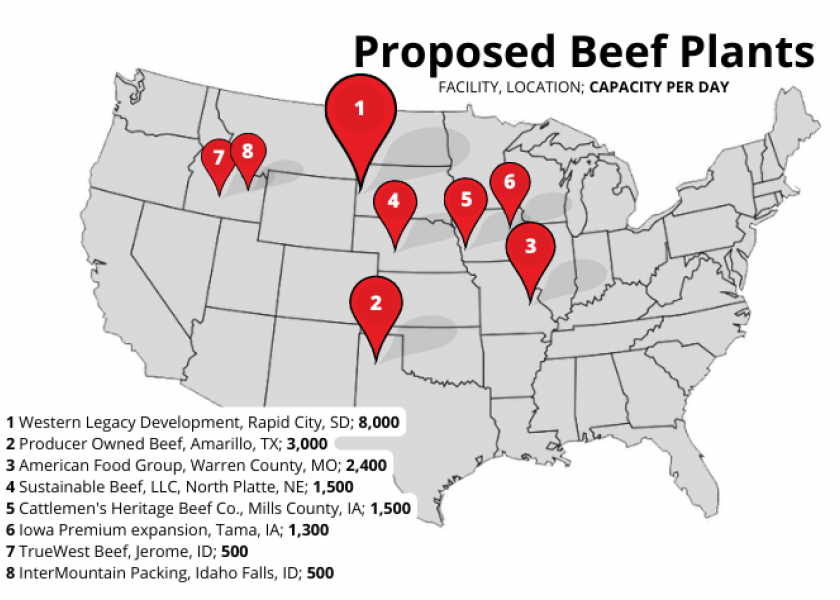

For instance, the most successful new plant in 2025 would be one that was built and operational in mid-2020. There are none of those. What’s proposed are at least seven new plants with capacity of 10,600 head per day, with an eighth proposal of a massive 8,000 head per day plant on the fringes of cattle feeding country. Only one of these new plants have moved dirt yet – though the expansion of the Tama, IA, plant by National Beef was into construction but was recently paused due to rising costs.

Veteran industry observers claim we don’t need additional packing capacity – other than a few local plants that can help service niche marketers. Last week, for instance, the industry saw steer and heifer slaughter total 523,698 head, a number that put packing capacity utilization at 91.1%. Capacity utilization of the plants currently operating will trend lower the next few years as cattle numbers recede. Would an additional 8% to 10% capacity lead to higher cattle prices?

If built, the proposed new plants would come online in 2024 or 2025, at a time when cattle numbers may be at historic lows. That’s an unavoidable fact given the current beef cow inventory and the unprecedented slaughter currently underway. Through May, beef cow slaughter was 15% higher than last year meaning a double-digit annual cow kill is already cooked. The U.S. beef cow inventory will likely be at least 2% lower on January 1.

Fewer cows and fewer feeder cattle creates higher prices and good news for ranchers. Not so much if you’re opening a new packing plant two years from now and buying cattle to run it.

Some supporters of proposed new plants see an “interesting dynamic because there will be new buyers on the street.” They suggest new bidders means higher prices. Are we sure that’s true? What guarantee do we have that any of the Big 4 will automatically raise bids to compete?

Packers currently running have seen their costs for labor and operations rise significantly since the beginning of the pandemic. Yes, they made historic per head profits. Obscene profits. But they are not obligated to give any of that back. Indeed, they may find it in their financial interest to just let some of their capacity sit idle while the new guys scramble for cattle.

Dwindling cattle supplies, rising construction costs, higher interest rates and fuel costs all create headwinds for any startup packer. But the biggest obstacle will be labor. That’s a fact that threatens all American businesses.

Investing in a packer startup is not a solution to low rancher profits. It’s fool’s gold.