COVID-19 Disruptions Causing Historic Economic Changes

Nearly two years after COVID-19 invaded our world, we are still living with its disruptions, but we should not overlook the more traditional factors also at play, says economist and financial expert Marci Rossell.

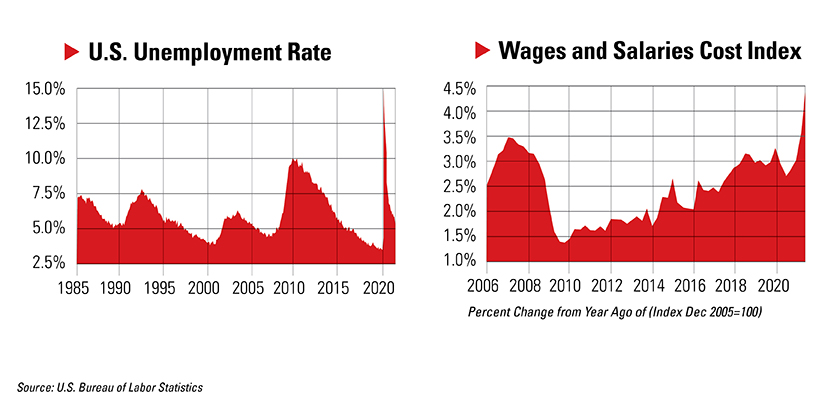

THE UNEMPLOYMENT PARADOX

Rossell, former chief economist for CNBC, says she has never seen such a shift in the labor market in a span of 18 months. COVID-19 spawned job losses, and now businesses face a worker shortage, despite the increase in wages and benefits.

“I expected when the added unemployment benefits were curtailed, the labor market would loosen up,” she says. “That is not what has happened.”

We are in the midst of a great labor realignment, Rossell says. The improvement that might have been seen collided

with demographics:

- People generally tend to be inert; they don’t like change. They stay in their same job with their same boss, in their same house. The pandemic cut such traditional connections.

- Since the pandemic, the U.S. has seen 1.33 million “excess” retirements as those who planned to stay on a bit longer were pushed over the edge.

- The number of people turning 18 years old (considered full employment age) has been falling. Ten years ago, it was 4.8 million annually; now it is 4.4 million, so there are 400,000 fewer potential employees every year.

- In 2020, there were 300,000 fewer babies born than expected, so that spells another labor shortage 18 years from now.

SPEEDY STOCK MARKET RECOVERY

The stock market initially fell 30% due to the pandemic; it is now 32% above its level prior to COVID-19, implying a positive outlook for the economy. Rossell says the rebound was not unexpected; the surprise was the speed of the recovery.

One contributing factor was the top five S&P companies actually benefiting from the pandemic: Amazon, Alphabet (Google), Microsoft, Apple and Facebook (now Meta).

“Next year these will probably not be as strong,” Rossell notes.

ENERGY PRICES ON THE REBOUND

Oil prices actually went negative for a time before the pandemic. The recent $80 per barrel was last seen in 2015, before the advent of the shale revolution that shifted the U.S. from the world’s largest importer to its largest producer and a net exporter.

For perspective, however, Rossell says: “Keep in mind that crude oil was priced at $130 per barrel at one time, $50 above recent prices.”

SHIPPING SNAFUS PLAGUE TRADE

Early in the pandemic, shipping firms could not find enough business and cut capacity by 11%. Now global shipping volume is 27% above pre-pandemic levels. The cost to ship a container jumped from $2,000 to $10,000. Ships are sitting in ports waiting to be unloaded.

“Trade relies on two-way traffic,” Rossell explains. “Asian countries did not support consumer income as the U.S. did, so demand for ships going back to Asia plummeted.”

Rossell predicts the imbalance in container use and lines at U.S. ports will ease in January, when the Chinese New Year shuts down the outflow from China. “But it will be a tough three months between now and then,” she cautions.

INFLATION RATES NEAR 30-YEAR HIGHS

Inflation is at its highest level in three decades, and September’s 4.4% surge was the fastest 12-month increase since 1991.

However, Rossell points out, the Federal Reserve watches the “trimmed mean rate of inflation,” which removes the outliers — single items that drive inflation in the short term. For instance, used cars account for a third of total inflation right now. Compared with September’s overall rate, the Trimmed Mean was only 2.3%.

Following its meeting the first week of November, the Federal Open Market Committee announced the Fed will start paring its $120 billion in monthly bond purchases by $15 billion per month, putting it on target to finish tapering mid-2022. No interest rate adjustment was announced.

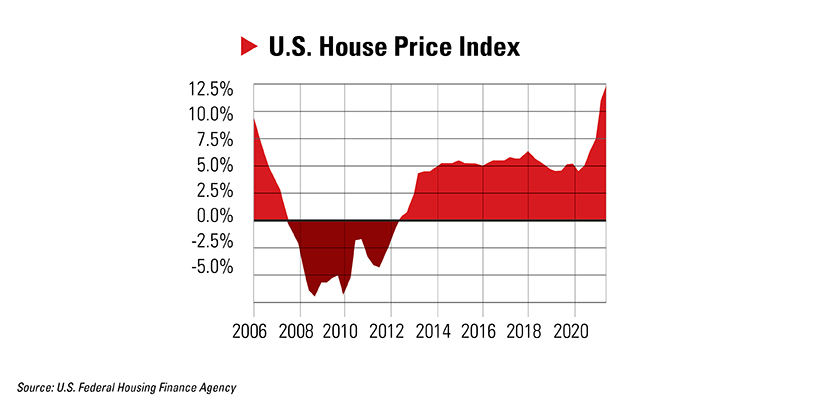

LIFE CHANGES DRIVE HOUSING

The housing market is up 20% in a single year. What is different from the bust of 2008:

- Leverage

- Lack of speculation

“Lending standards are high right now; the threat of default is not similar to the past boom,” Rossell says.

People’s COVID-19-created desire to live differently, not speculation, is driving this boom. Changes in life, work and play are permanent, and those changes mean new needs in living space — an office, perhaps an in-home gym, better cooking space, possibly a garden.

Demographics are driving the housing market: Most Millennials are buying homes in their 30s and this is the key decade. At the same time, the number of builders and construction companies are falling, while materials are in tight supply.