COOL 2.0 Won’t Improve Producer Prospects

My previous column addressed some of the touted claims in support of COOL. However, the evidence is clear the law failed to: 1. Slow beef import tonnage coming to the U.S., 2. Provide U.S. beef producers better prices compared to their foreign counterparts, and 3. Improve beef demand.

Some of the feedback I received was telling. Much of it proclaiming the data presented doesn’t really matter. The only thing that matters are the believed benefits. And even if COOL didn’t make things better for producers or consumers, let’s proceed anyway because there’s not really any cost associated with implementing the program. So, let’s tackle that perspective.

Let’s first review the issue on the demand / benefit side. As reminder from the previous column, USDA's Report to Congress: Economic Analysis of Country of Origin Labeling asserted COOL didn’t improve beef demand. The report states: “…we found no evidence that consumer demand for beef or pork has increased because of MCOOL. Thus, our economic analysis finds no measurable benefits to consumers as a result of the MCOOL rules.”

From the cost side, the mandate requires additional compliance measures (e.g. record-keeping, documentation, logistic complexities, etc…). To offset cost associated with those added requirements, the USDA report summarizes demand needed to improve more than 7%. But without any measurable shift in demand, producers are left holding the bag

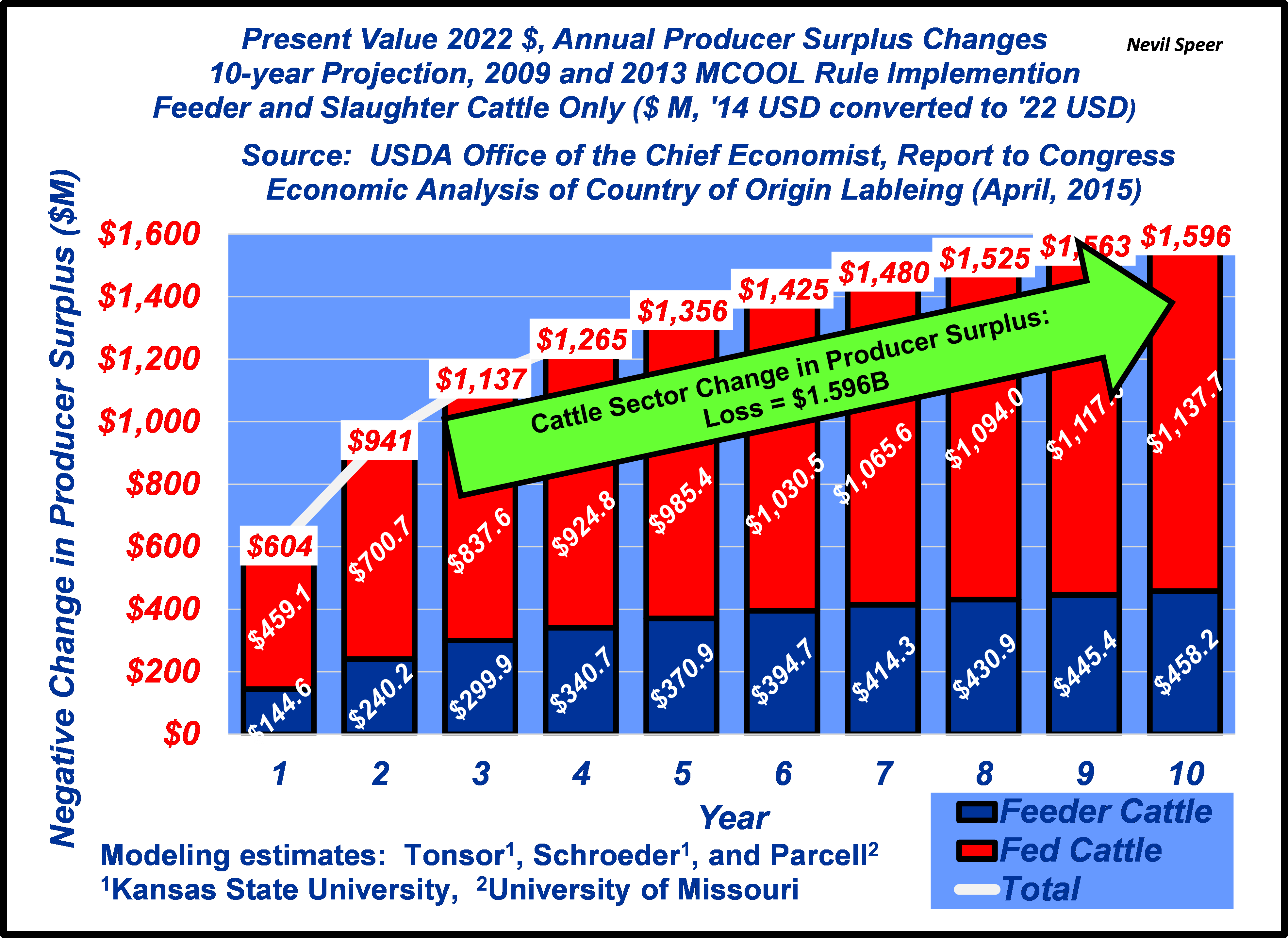

To that end, USDA models the net outcome from a producer surplus perspective: “…the net gain that producers receive for producing and selling a good…[it] is a measure of the economic welfare or benefit that producers collectively receive for selling a good in the marketplace.” Based on the modeling estimates, implementation of COOL results in producer surplus declining nearly $1.6B (basis 2022 dollars) in the cattle sector over the span of ten years (see first graph). Undoubtedly, that decline will disproportionately harm smaller producers who inherently possess higher costs of production.

Never mind all that, there’s a new rationale for COOL that’s been thrown into the hopper: packer margins. The argument being that packer margins began to surge after COOL was repealed. As such, the law must have been holding the packer in check. And if we reinstate COOL, producers will get back to better days. Right?

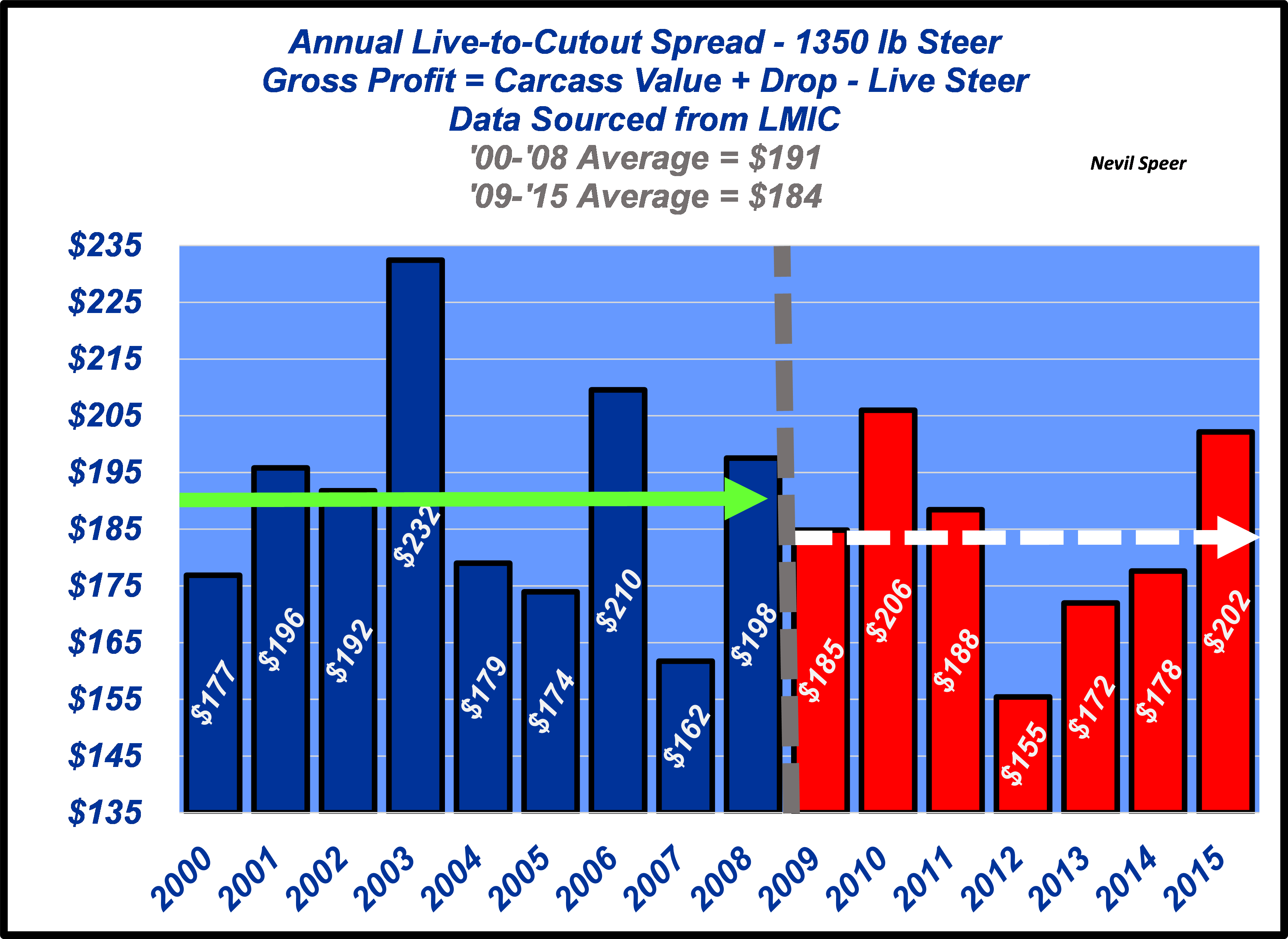

That’s not what the data says. The second graph details annual packer gross profit both pre- and post-COOL. Gross margins averaged $191/head in the nine years leading up to COOL (’00-’08). However, that number barely budged during the next seven years (’09-’15) while COOL was in effect.

Widening margins during the past several years have occurred for multiple reasons. The timing of that occurrence post-COOL is coincidental. But it’s important to remember, the absence of COOL isn’t causal to that occurrence. It’s an important difference. And as such, the argument is a head fake. In summary, COOL did nothing to alter packer margins the first time around, so there’s little reason to think this time will be different.

The phenomenon of target-fixation originated during WWII. To make an accurate drop, bomber pilots become singularly focused on their target; but in doing so, they lose track of the altitude and end up flying into the ground. That’s seemingly where we find ourselves with COOL 2.0. It’ll leave producers worse off – not better.

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at nevil.speer@turkeytrack.biz.